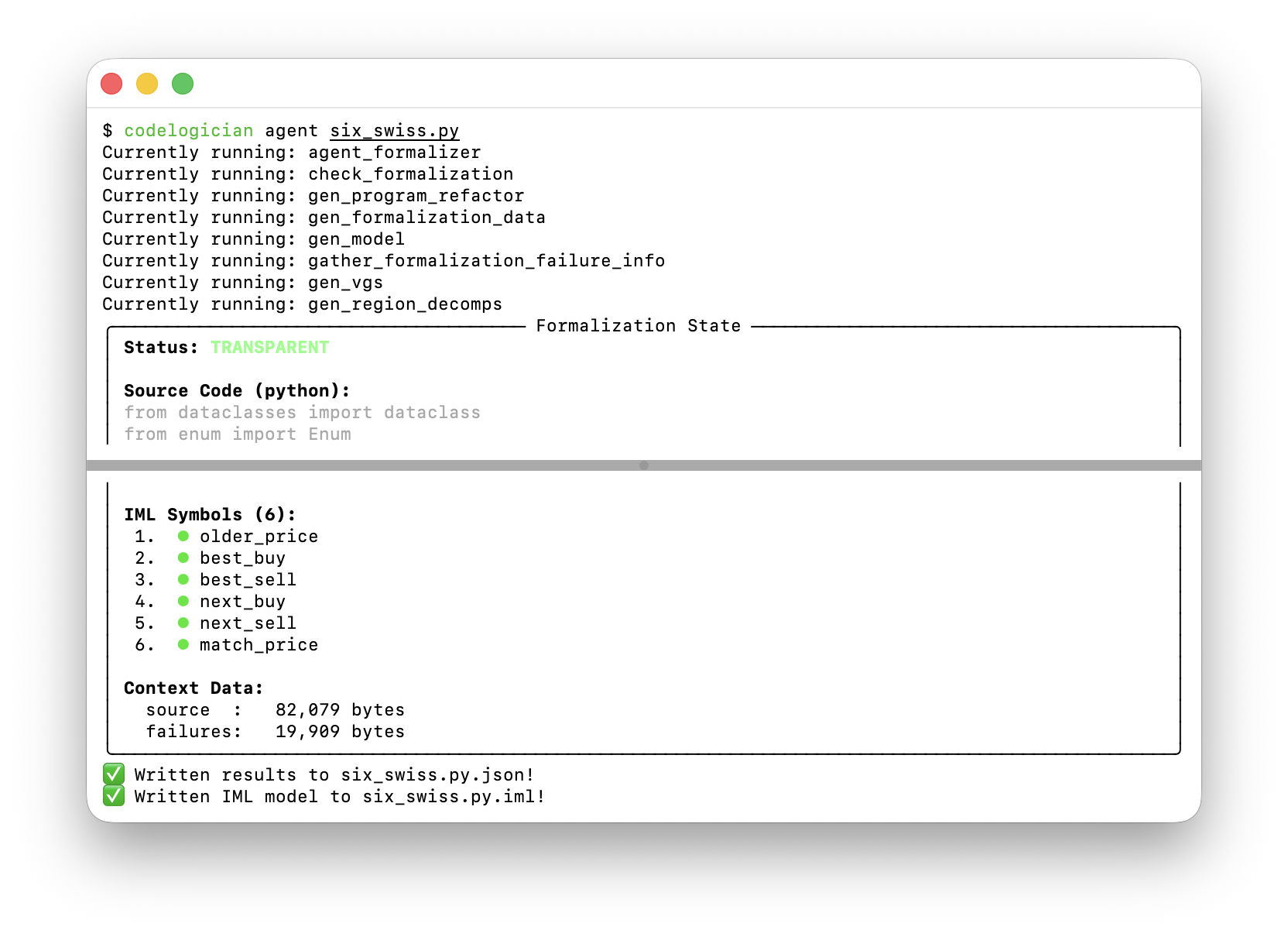

Invoking agents via CLI

CodeLogician includes an agentic formalizer that can autonomously formalize source code into IML.

Running codelogician agent FILE will invoke CodeLogician's agentic formalizer ...

... and return the IML model produced and a json of the agent's state.

Options

By default, the agent will try to generate verification goals and decomposition requests. This can be disabled with

codelogician agent --no-artifacts FILESave the IML model and agent's state to files with names of your choosing by provding MODELFILE and OUTFILE.

codelogician agent FILE [MODELFILE] [OUTFILE]Evaluation via CLI

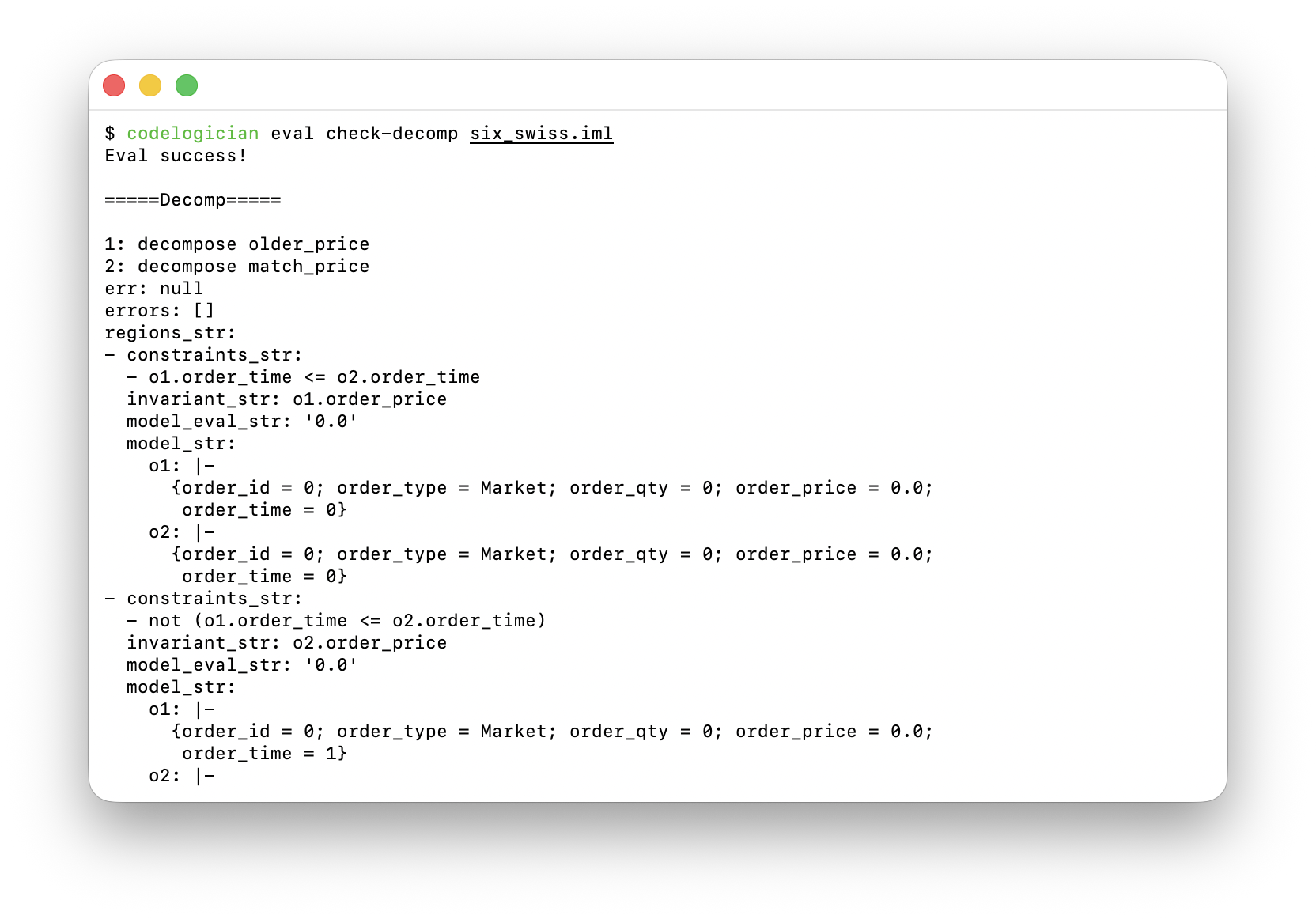

Region Decomposition

To perform region decomposition, a [@@decomp ...] annotation must be attached to the definition of the function of interest.

In the below example, we added

[@@decomp top ()]after the older_price and match_price functions.

IML

type order_type =

| Market

| Limit

| Quote

type order = {

order_id : int;

order_type : order_type;

order_qty : int;

order_price : real;

order_time : int;

}

type fill_price = real option

let older_price (o1 : order) (o2 : order) : real =

if o1.order_time > o2.order_time then

o2.order_price

else

o1.order_price

[@@decomp top ()]

type order_book = {

buys : order list;

sells : order list;

}

let best_buy (ob : order_book) : order option =

List.nth 0 ob.buys

let best_sell (ob : order_book) : order option =

List.nth 0 ob.sells

let next_buy (ob : order_book) : order option =

List.nth 1 ob.buys

let next_sell (ob : order_book) : order option =

List.nth 1 ob.sells

(_ Helper to access Option content safely or return default _)

let get_price (o : order option) : real option =

match o with

| Some x -> Some x.order_price

| None -> None

(_ Comparison operators for real numbers _)

let (<.) x y = Real.(x < y)

let (>.) x y = Real.(x > y)

let match_price (ob : order_book) (ref_price : real) : fill_price =

let bb = best_buy ob in

let bs = best_sell ob in

match bb, bs with

| Some bb, Some bs ->

let bb_type = bb.order_type in

let bs_type = bs.order_type in

if (bb_type = Limit && bs_type = Limit) || (bb_type = Quote && bs_type = Quote) then

Some (older_price bb bs)

else if bb_type = Market && bs_type = Market then

if bb.order_qty <> bs.order_qty then

None

else

let b_bid =

match next_buy ob with

| Some nb -> if nb.order_type <> Market then Some nb.order_price else None

| None -> None

in

let b_ask =

match next_sell ob with

| Some ns -> if ns.order_type <> Market then Some ns.order_price else None

| None -> None

in

match b_bid, b_ask with

| None, None -> Some ref_price

| None, Some ask -> Some (if ask <. ref_price then ask else ref_price)

| Some bid, None -> Some (if bid >. ref_price then bid else ref_price)

| Some bid, Some ask ->

if bid >. ref_price then Some bid

else if ask <. ref_price then Some ask

else Some ref_price

else if bb_type = Market && bs_type = Limit then

Some bs.order_price

else if bb_type = Limit && bs_type = Market then

Some bb.order_price

else if bb_type = Quote && bs_type = Limit then

if bb.order_time > bs.order_time then

(* incoming quote *)

if bb.order_qty < bs.order_qty then

Some bs.order_price

else if bb.order_qty = bs.order_qty then

match next_sell ob with

| Some ns -> Some ns.order_price

| None -> Some bb.order_price

else

None

else

(* existing quote's price used *)

Some bb.order_price

else if bb_type = Quote && bs_type = Market then

if bb.order_time > bs.order_time then

(* incoming quote *)

let next_sell_limit = next_sell ob in

if bb.order_qty < bs.order_qty then

Some bs.order_price

else if bb.order_qty = bs.order_qty then

match next_sell_limit with

| Some ns -> Some ns.order_price

| None -> Some bb.order_price

else

None

else

Some bb.order_price

else if bb_type = Limit && bs_type = Quote then

if bb.order_time > bs.order_time then

(* incoming quote *)

if bs.order_qty < bb.order_qty then

Some bb.order_price

else if bs.order_qty = bb.order_qty then

match next_buy ob with

| Some nb -> Some nb.order_price

| None -> Some bs.order_price

else

None

else

Some bs.order_price

else if bb_type = Market && bs_type = Quote then

if bb.order_time > bs.order_time then

(* incoming quote *)

if bs.order_qty < bb.order_qty then

Some bs.order_price

else if bb.order_qty = bs.order_qty then

match next_buy ob with

| Some nb -> Some nb.order_price

| None -> Some bs.order_price

else

None

else

Some bs.order_price

else

None

| \_ -> None

[@@decomp top ()]

Begin the region decomposition with

codelogician eval check-decomp MODELFILE

Learn more about region decomposition here.

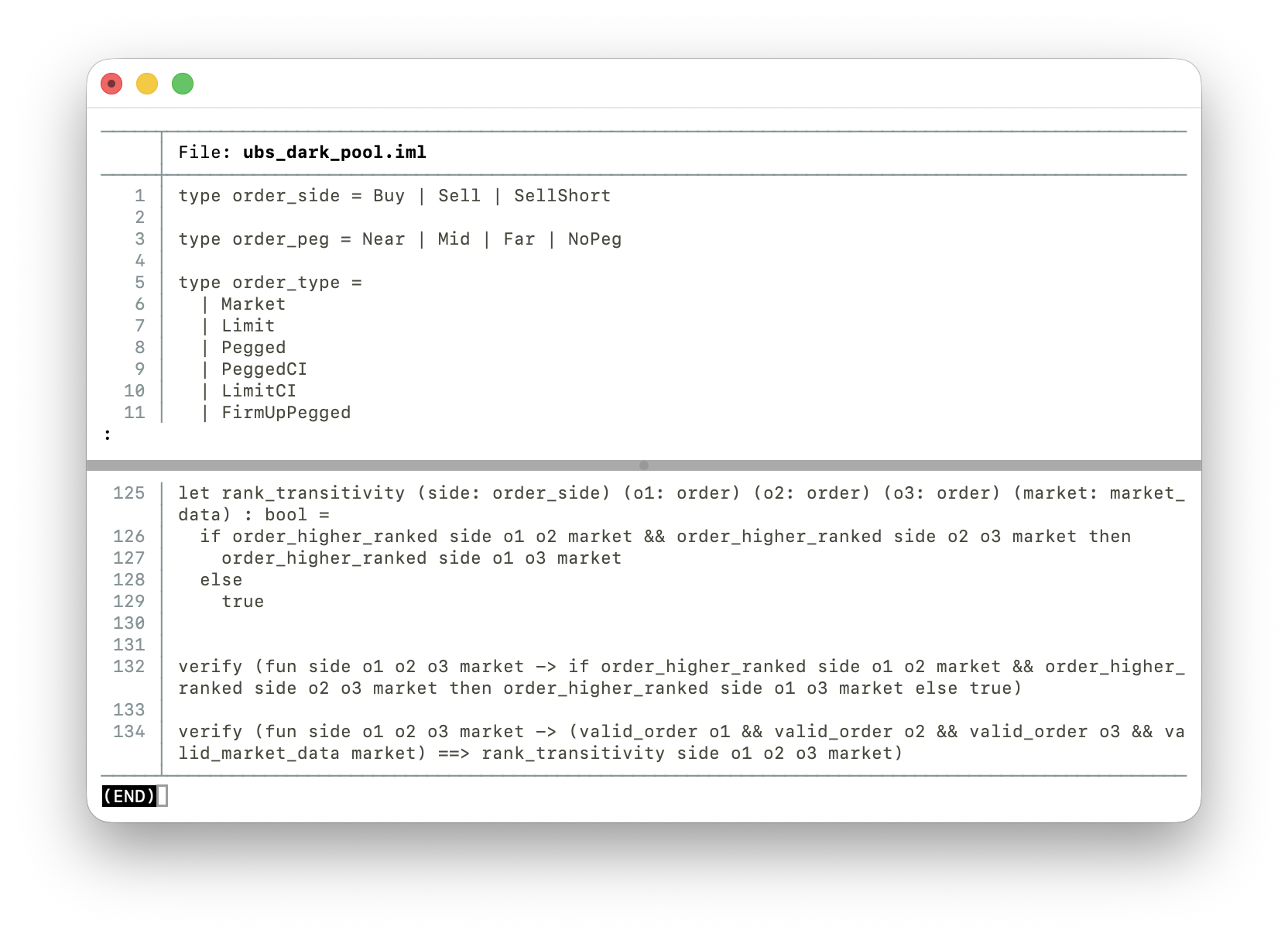

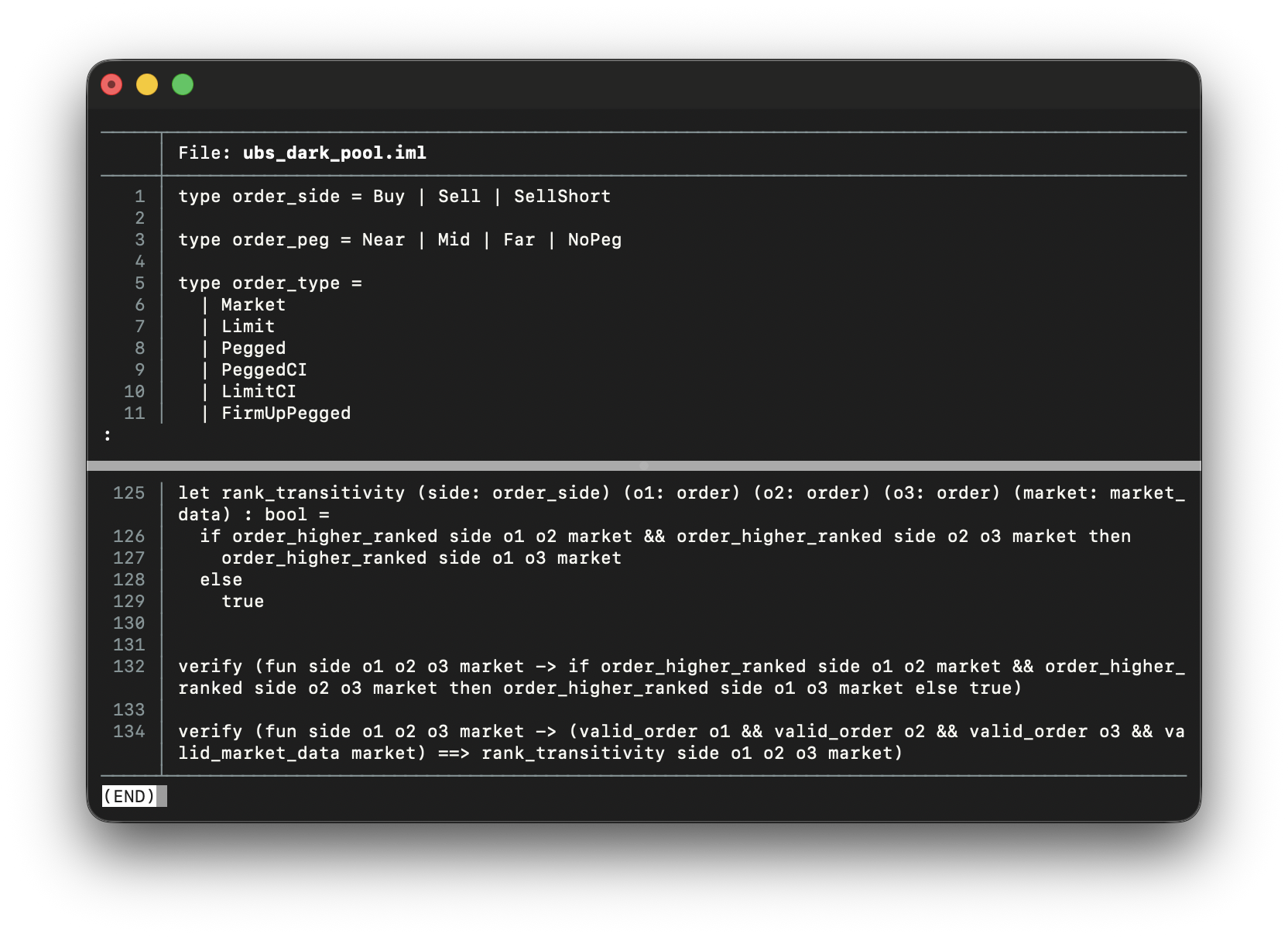

Verification Goals

Use [@@verify ...] annotations to express verification goals.

We'll use the UBS Dark Pool example to demonstrate.

The IML file has two verification goals for properties that we want to hold true.

IML

type order_side = Buy | Sell | SellShort

type order_peg = Near | Mid | Far | NoPeg

type order_type =

| Market

| Limit

| Pegged

| PeggedCI

| LimitCI

| FirmUpPegged

| FirmUpLimit

let is*ci (ot : order_type) : bool =

match ot with

| PeggedCI | LimitCI -> true

| * -> false

let is*limit_type (ot : order_type) : bool =

match ot with

| Limit | LimitCI | FirmUpLimit -> true

| * -> false

let is*pegged_type (ot : order_type) : bool =

match ot with

| Pegged | PeggedCI | FirmUpPegged -> true

| * -> false

type market_data = {

nbb: real;

nbo: real;

l_up: real;

l_down: real

}

let mid_point (mkt: market_data) : real =

(mkt.nbb +. mkt.nbo) /. 2.0

let valid_market_data (mkt: market_data) : bool =

mkt.l_down >. 0.0 &&

mkt.nbb >. mkt.l_down &&

mkt.nbo >. mkt.nbb &&

mkt.l_up >. mkt.nbo

type order = {

id: int;

peg: order_peg;

client_id: int;

order_type: order_type;

qty: int;

min_qty: int;

leaves_qty: int;

price: real;

time: int

}

let valid_order (o: order) : bool =

o.leaves_qty <= o.qty &&

o.time >= 0 &&

o.price >. 0.0 &&

o.qty > 0 &&

o.leaves_qty >= 0

let less*aggressive (side: order_side) (lim_price: real) (far_price: real) : real =

if lim_price <. 0.0 then

far_price

else

match side with

| Buy -> min_r lim_price far_price

| * -> max_r lim_price far_price

let priority*price (side: order_side) (o: order) (mkt: market_data) : real =

match o.order_type with

| Limit | LimitCI | FirmUpLimit ->

(match side with

| Buy -> less_aggressive Buy o.price mkt.nbo

| * -> less*aggressive Sell o.price mkt.nbb)

| Market ->

(match side with

| Buy -> mkt.nbo

| * -> mkt.nbb)

| _ -> (* Pegged types *)

match o.peg with

| Far ->

less_aggressive side o.price

(match side with

| Buy -> mkt.nbo

| _ -> mkt.nbb)

| Mid ->

less*aggressive side o.price (mid_point mkt)

| Near ->

less_aggressive side o.price

(match side with

| Buy -> mkt.nbb

| * -> mkt.nbo)

| NoPeg -> o.price

let order_higher_ranked (side: order_side) (o1: order) (o2: order) (market: market_data) : bool =

let p_price1 = priority_price side o1 market in

let p_price2 = priority_price side o2 market in

let price*comparison =

match side with

| Buy -> p_price1 -. p_price2

| * -> p_price2 -. p_price1

in

if price*comparison >. 0.0 then

true

else if price_comparison <. 0.0 then

false

else

(* Same price level - apply additional rules \_)

if is_ci o1.order_type && is_ci o2.order_type then

o1.leaves_qty > o2.leaves_qty

else if o1.time <> o2.time then

o1.time < o2.time

else if not (is_ci o1.order_type) && is_ci o2.order_type then

true

else if is_ci o1.order_type && not (is_ci o2.order_type) then

false

else

o1.leaves_qty > o2.leaves_qty

let rank_transitivity (side: order_side) (o1: order) (o2: order) (o3: order) (market: market_data) : bool =

if order_higher_ranked side o1 o2 market && order_higher_ranked side o2 o3 market then

order_higher_ranked side o1 o3 market

else

true

verify (fun side o1 o2 o3 market -> if order_higher_ranked side o1 o2 market && order_higher_ranked side o2 o3 market then order_higher_ranked side o1 o3 market else true)

verify (fun side o1 o2 o3 market -> (valid_order o1 && valid_order o2 && valid_order o3 && valid_market_data market) ==> rank_transitivity side o1 o2 o3 market)

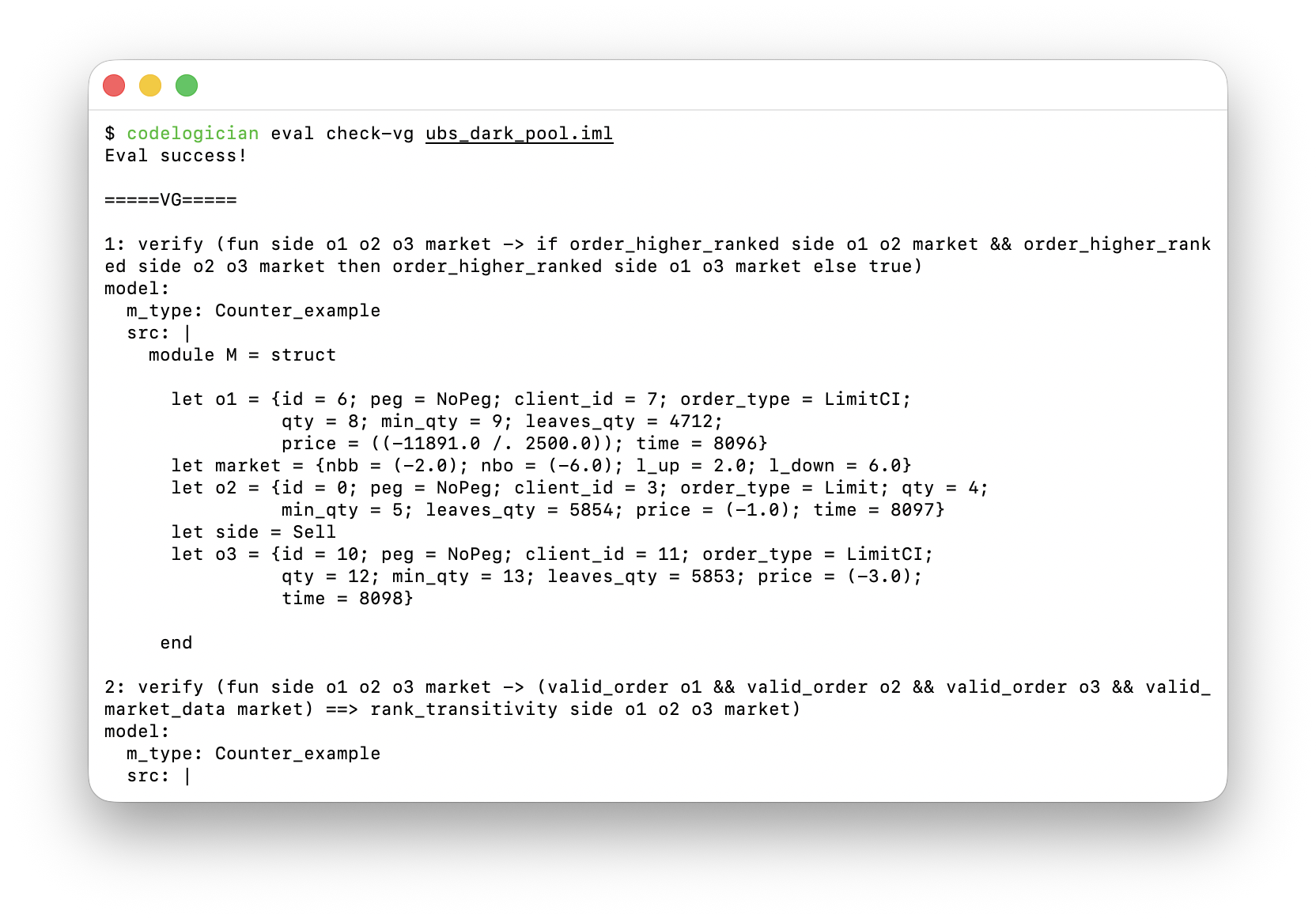

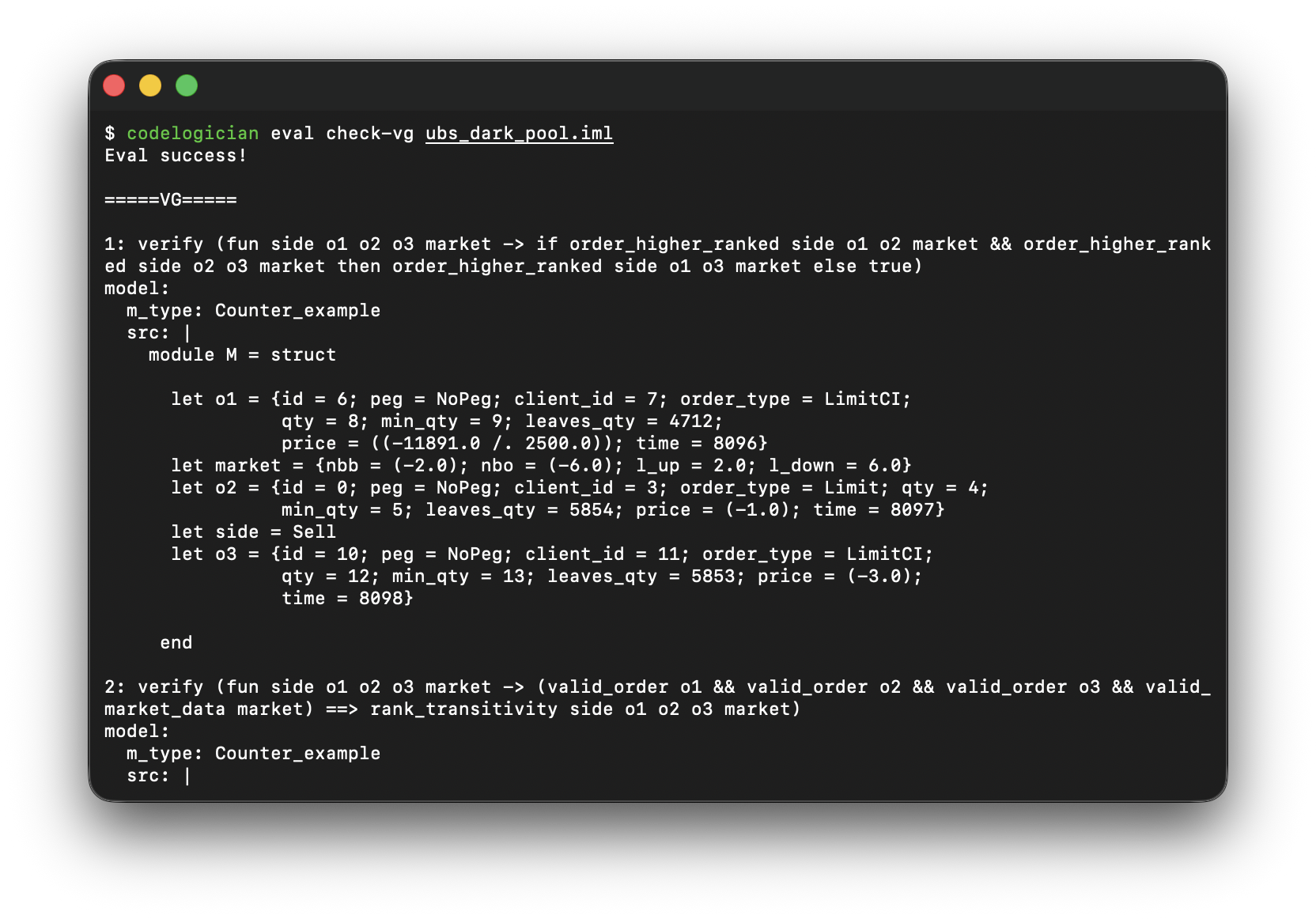

Perform verification with

codelogician eval check-vg MODELFILE

The results show that ImandraX was able to find counterexamples to the verification goals.